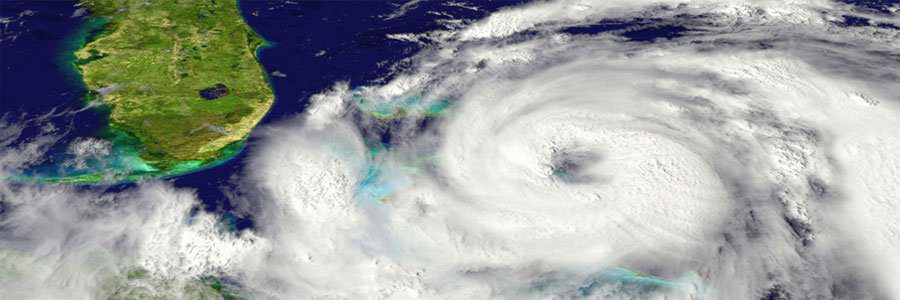

As Matthew brews in the tropics, we’re reminded of the danger hurricanes could cause to Florida. If you’re new to the state, you most likely have never heard of a hurricane deductible. However, it’s a concept that property owners in our state need to understand.

Unlike your normal “All Other Perils (AOP)” deductible that requires you to pay a stated dollar amount (usually $1,000 or $2,500), a hurricane deductible requires you to pay a percentage of your property value before the insurance company is required to pay out on a claim.

This means that the more expensive your home is to rebuild, the more you must pay out in the event of a loss by a hurricane. For example, if you have a $300,000 house and a 2% deductible, you would pay out $6,000 before the insurance policy would respond.

So What Exactly is a Hurricane?

For most insurers a “hurricane” is a storm system that has been declared to be a hurricane by the National Hurricane Center of the National Weather Service.

The duration of the hurricane includes the time period beginning at the time a hurricane watch or warning is issued for ANY part of Florida by the National Hurricane Center, and it continues for the time period during which hurricane conditions exist anywhere in Florida. A hurricane ends 72 hours following the termination of the last hurricane watch or hurricane warning issued for Florida by the National Hurricane Center.

So that means even if you don’t have hurricane-like conditions in your area, any losses you incur most likely will still be subject to your Hurricane deductible.

Then What’s a Calendar Year Hurricane Deductible?

After the crazy hurricane seasons of 2004 and 2005 many property owners in our state faced paying multiple high hurricane deductibles. Due to the situation which caused a financial burden on many homeowners, the insurance industry decided to come up with what they call a “calendar year” hurricane deductible.

A calendar year hurricane deductible allows for your hurricane deductible only to apply once per year. Once the hurricane deductible is exhausted the all other perils deductible would apply to future hurricane related claims. The deductible encourages property owners to submit all claims to their homeowners’ carrier, even if they believe they will be below the deductible.

What About Other Wind Events?

As long as you have a hurricane deductible, and not a wind/hail deductible (common to Commercial Property policies), your all other perils deductible (or All other Wind deductible on Wind only policies) will apply to other wind losses, such as a tornado, that are separate from a “hurricane.”

Conclusion

If you have a property insurance policy in Florida it’s important that you understand the implications that your hurricane deductible has on your coverage. Based on your personal situation it may make sense to either decrease or increase your hurricane deductible.

If you have any questions about your Homeowners or Commercial Property coverage, please contact Brian Ford at BFord@InsuranceResourcesLLC.com