In June the Federal Emergency Management Agency (FEMA) released new preliminary flood maps for Pinellas County. Flood zone remapping is part of FEMA’s continuous efforts to properly evaluate and assign properties into appropriate flood zones. The changes, which will not become effective until later in 2019 or 2020 (depending on community approval) are the first changes Pinellas county has seen since 2009.

You can view the actual preliminary flood maps on FEMA’s Preliminary Map Products website. Pinellas County also has some great interactive maps on the Pinellas County’s Flood Information website and on the Pinellas County Preliminary and Current FEMA Flood Insurance Rate Map website. Please note preliminary maps are subject to change after review.

What is Flood Zone Remapping?

Flood zone remapping is the process by which FEMA and other private sector partners review, reevaluate, and implement new flood zone maps. New maps provide accurate information regarding a property’s potential for flooding.

Why is Flood Zone Remapping Necessary?

There are a few reasons why it’s necessary to continually remap zones:

- Landscape changes

- Water levels can change as a result of buildings being built, weather patterns changing, surfaces eroding, natural events (i.e. hurricanes or wildfires) occurring, or waters levels rising. Development in certain areas may be great for the economy, but with less places for water to drain, the greater chance for flooding you may see.

- Technological improvements

- The exponential growth of technology has allowed engineers, surveyors, & meteorologists to better grasp the potential for a particular area’s risk of flooding. New flooding maps will be put onto digital flood insurance rate maps (D-FIRMS). D-FIRMS allow for easy searching and efficiencies in the way both communities and insurance companies work with flood maps

- Community preparedness

- As landscape changes occur communities need to know how best to prepare and plan for flood risks. Increases in base flood elevations may require communities to increase their lowest floor elevation requirements for new construction.

What Changes Will the Beaches of Pinellas County See?

Overall, about 80-85% of beach residents will see a positive result from the mapping changes. Many properties are seeing 1-2 foot reductions in their base flood elevations. Therefore properties built after 1974 (Post-FIRM) and properly elevated will see nice reductions in their flood premium. However, properties built built prior to 1974 (pre-FIRM properties) typically won’t benefit from these reduced elevations. This is because these properties are already receiving a premium that is less expensive than the actuarially rated premium.

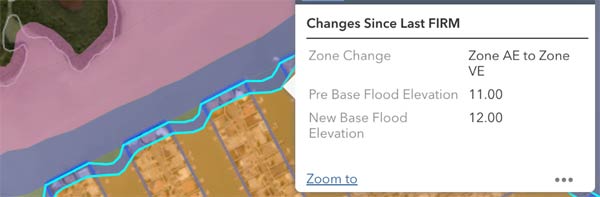

Many coastal properties are also being remapped out of the expensive high velocity VE zones and into the coastal AE zones. This will result in huge premium savings for these individuals! However, the opposite is also true. For example, many of the properties at the edges of the fingers on Isle of Capri and Isle of Palms in Treasure Island are moving to the VE zones (see photo below).

What About the Flood Mapping Changes for the Rest of Pinellas County?

The effect on map changes always depends on where the property lies. If your property was not in a special flood hazard area before, but near one you most likely have a greater chance of now lying inside the special flood hazard area. Those located in the special flood hazard areas also commonly see changes in the base flood elevations. For example, many properties in Snell Isle and Shore Acres are seeing base flood increases of 1-2 feet which will result in higher flood premiums.

Options If Your Property Is Moving into a Special Flood Hazard Area

If your property is moving into a special flood hazard area or if your base flood elevation is changing you may still have options to either keep your current zone or to have a reduced flood insurance premium.

-

Grandfathering Your Flood Zone

As long as you have continuous flood coverage with the NFIP (not a private flood market), most properties that will see negative effects from flood zone remapping are able to grandfather their current flood zone or base flood elevation. For example, if your property is moving from a AE to a high velocity VE zone you can grandfather the AE zone for rating purposes. It’s important to note that new buyers are not eligible for continuous coverage grandfathering. However, they may be eligible to assume a property owner’s flood policy.

-

Newly Mapped Procedure

The NFIP allows for property owner’s that are newly mapped into a special flood hazard area to purchase coverage at a discounted cost through the Newly Mapped Procedure. Traditionally to take advantage of these savings, property owners must have purchased a policy within 12 months of the map change. As of October 1, 2018 the NFIP also allows property owners to take advantage of the Newly Mapped Procedures as long as they get coverage within 45 days of the initial bank lender notification (as long as that occurs within 24 months of the map revision). With the Newly Mapped Procedure, the first year premium is similar to the preferred risk premium. However, the subsequent renewal premiums will then increase up to 18% until they equal the true actuarial premium.

Flood zone remapping is a continuous process. When purchasing a home in Pinellas county, you must be aware of your home’s potential for flooding and the cost associated with insuring it. However, flood zone changes can have major effects on that cost. We encourage Pinellas county residents to pay attention to mapping changes and to communicate with their insurance agent. For questions about how flood map changes will affect your premium, please contact Brian Ford at bford@insuranceresourcesllc.com or 727-345-0242.