On March 21, 2014, President Obama signed the Homeowner Flood Insurance Affordability Act (HFIAA) of 2014. The law repealed certain provisions of the Biggert-Waters Flood Insurance Reform Act of 2012, which was going to cause havoc on many residential properties in Pinellas County. HFIAA slowed some flood insurance rate increases & offered relief to policyholders who experienced steep increases in 2013 and 2014 due to Biggert-Waters. However HFIAA also called for reforms to the National Flood Insurance Program (NFIP), the government entity which provides flood insurance for millions of US properties, which is $24 Billion in debt due in large part to Hurricane Katrina (2005) and Superstorm Sandy (2012).

We are getting ready to see some of these major changes effective April 1, 2015. These changes include rate increases for most policies, an increase in the Reserve Fund Assessment, the implementation of an annual surcharge on all new & renewed policies, an increase in the Federal Policy Fee, and an additional deductible option.

Rate Increases

Flood insurance premiums will continue to rise. With some exceptions, premiums will rise between 5% – 15% for average rate classes, with individual policy premiums to be capped at 18% before applying the Annual Surcharge & Federal Policy Fee.

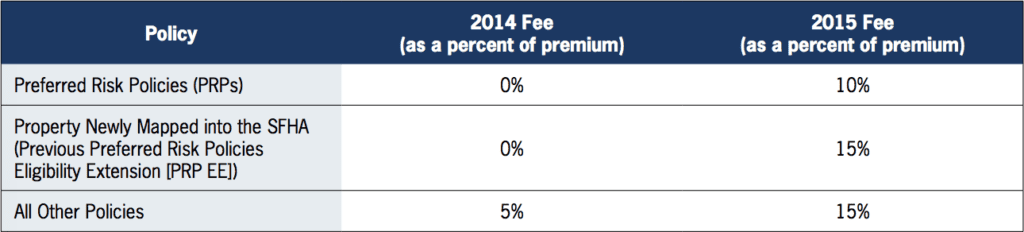

Reserve Fund Assessment Increasing

Biggert-Waters required the implementation of a Reserve Fund to help cover costs when claims exceed the annual premium collected by the NFIP. Starting April 1st these fees are increasing, and are now being required on Preferred Risk Policies.

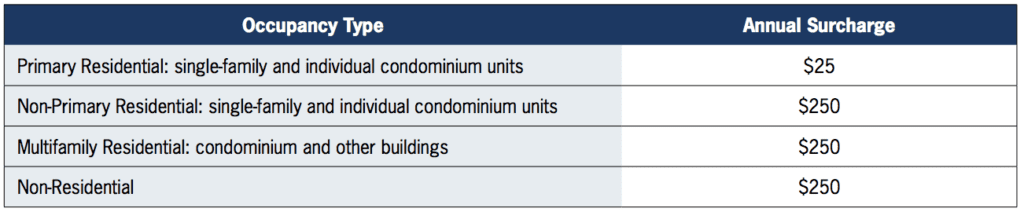

HFIAA Surcharge

Also beginning April 1st, all policies will be assessed a surcharge that will be collected until all program subsidies are eliminated. The surcharge is a flat fee applied to all policies based on the occupancy type. It is not associated with the flood zone of the building or the date of construction. To verify primary residence, NFIP will be sending policyholders a letter 90 days before renewal. The letter requires the insured to certify that they will live in a residence 80% or more of the 365 days following the renewal date. Insureds must check a box on the letter, and send a copy of their driver’s license, vehicle registration, auto insurance, voter’s registration, document showing where your kids attend school, or a Homestead Tax Credit Form. You can either submit this documentation directly to NFIP or provide it to our agency to send to NFIP.

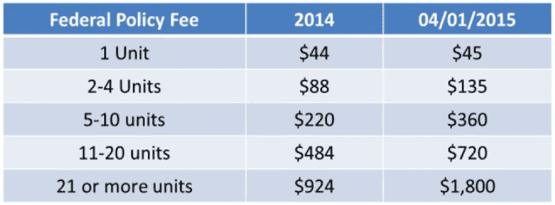

Federal Policy Fee Increase

The Federal Policy Fee will be increasing by $1 for most policies. An exception is policies rated using the map change table, whose Federal Policy Fee will increase by $45. As seen below, Residential Condominium Building Associations Policies (RCBAPs) will incur a fee based on the number of units within the association.

New Deductible Option

A new deductible of $10,000 will be available for both building and contents effective April 1st. The deductible is available for single family & 2-4 family dwellings. Selecting higher deductibles will help to reduce your premium, but we recommend contacting your lender before making any deductible changes. Some lenders have maximums on the deductibles that they will allow.

For more information please visit the following websites: